1 Explain the Journal Entry Method of Recording End-of-period Adjustments

What are Prior Period Adjustments. An interim period is any reporting period shorter than a full year fiscal or calendar.

Record And Post The Common Types Of Adjusting Entries Principles Of Accounting Volume 1 Financial Accounting

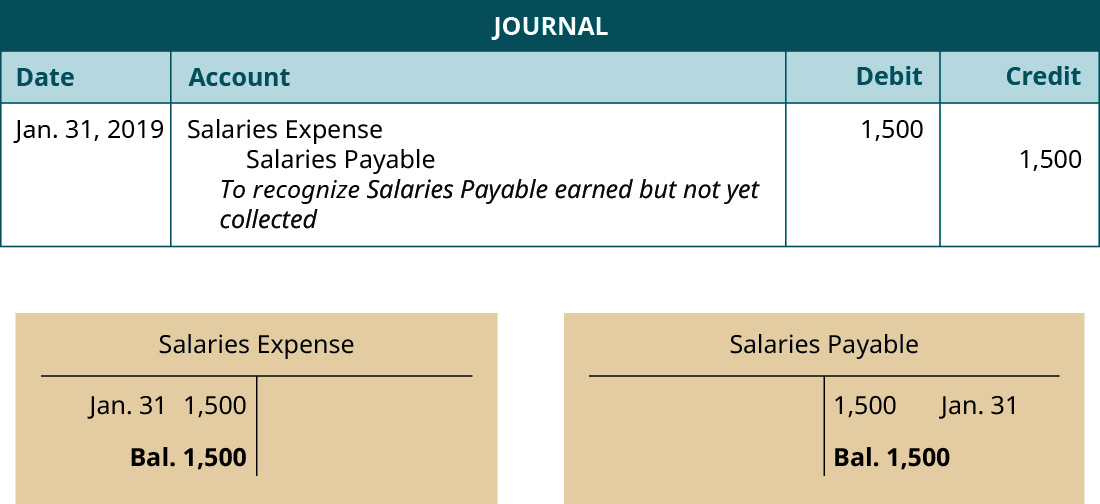

When a business entity owes wages to employees at the end of an accounting period they make an adjusting journal entry by debiting wages expense and crediting wages.

. Start studying Ch 4 Recording Adjusting Closing and Reversing Entries. Here are the three main steps to record an adjusting journal entry. But at the end of the fiscal year some of the accounts.

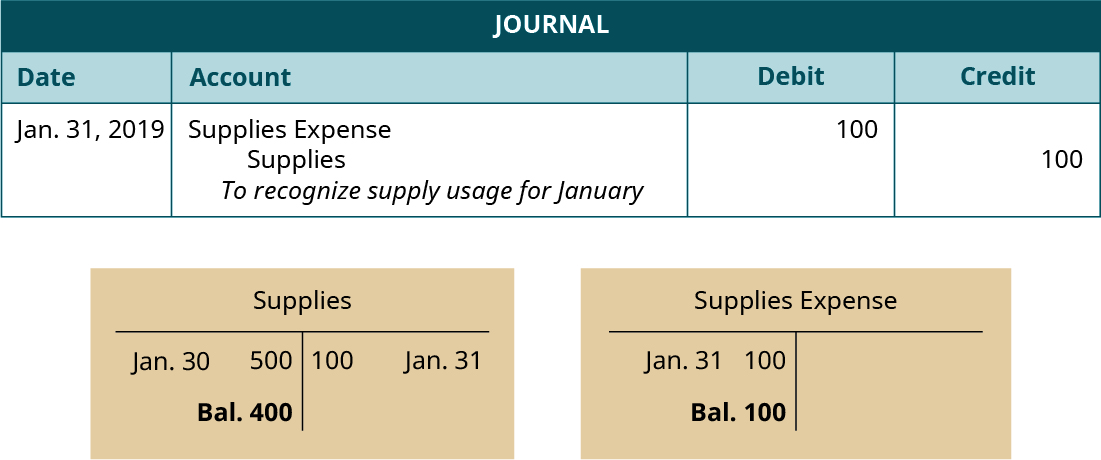

Adjusting entries for accruing unpaid expenses. The appropriate end-of-period adjusting entry establishes the Prepaid Expense account with a debit for the amount relating to future periods. -Define accounting and the concepts of accounting measurement -Explain the role of a bookkeeper and common bookkeeping tasks and.

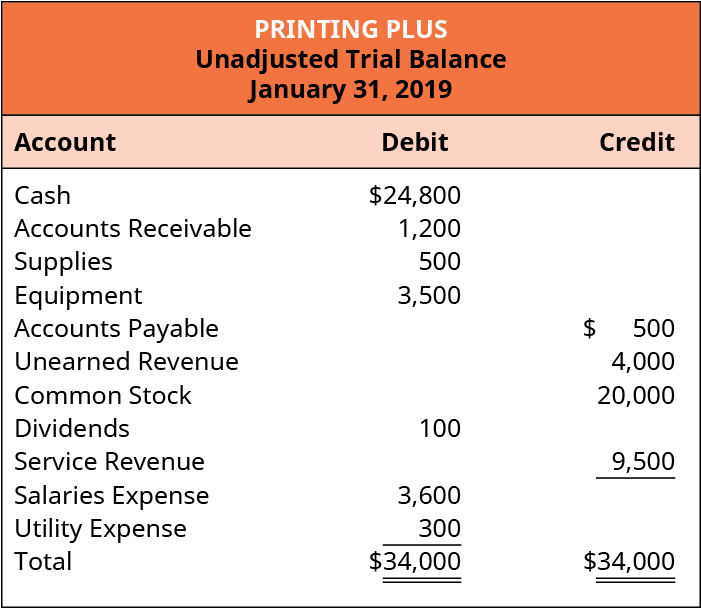

Adjusting entries are journal entries recorded at the end of an accounting period to alter the ending balances in various general ledger accounts. Adjusting entries are required at the end of each fiscal period to align the revenues and expenses to the right period in accord with the matching principle Matching Principle The matching. One of the steps in an accounting cycle is the process called adjusting entries.

Each adjusting entry has a dual purpose. This can encompass monthly quarterly or half-year statements. When a company reaches the end of a period it must update certain accounts that have either been left unattended throughout the period or have not yet been recognized.

Accounting of Adjusting Journal Entries. Why Make Adjusting Entries. End-of-period-adjustments apply the matching principle of.

A remove the earned amount to a revenue account b. Prior period adjustments are adjustments made to periods that are not a current period but already accounted for because there are a lot of metrics where. Determine what current balance should be.

31 Describe Principles Assumptions and Concepts of Accounting and Their Relationship to Financial Statements. When a business firm owes wages to employees at the end of an accounting period they make an adjusting entry by debiting wage expenses and crediting wages payable. According to matching principle the expense must be matched against recognized revenue.

32 Define and Describe the Expanded Accounting. Here are some of the most common types. When a company reaches the end of a period it must update certain accounts that have either been left unattended throughout the period or have not yet been recognized.

The offsetting credit reduces the expense to an. Using Quickbooks Accountant 2014 13th Edition Edit edition Solutions for Chapter 9 Problem 1Q. Adjusting Entries Example 2 Prepaid Expenses.

The information contained on these. An alternative to recording a prepayment of revenue initially as a revenue as opposed to a liability requires a period-end adjusting entry to. You create adjusting journal entries for different reasons at the end of accounting periods such as accruals deferrals or depreciation.

Jeff owner of Azon wants to ensure the inventory or stock of the company. Explain the journal entry method of recording end-of-period adjustments. Accountants record these journal entries in the general ledger accounts and.

Determine current account balance. He purchased an insurance policy on June 1 2018 for a. By the end of this course you will be able to.

Unpaid expenses are expenses which are incurred but no cash payment is made during the period. Entries made at the end of each reporting period to transfer the balances of the temporary owners equity accounts. 1 to make the income statement report the proper revenue or expense and 2 to make the balance sheet report the proper asset or liability.

End-of-period adjustments are also known as year-end-adjustments adjusting-journal-entries and balance-day-adjustments.

Record And Post The Common Types Of Adjusting Entries Principles Of Accounting Volume 1 Financial Accounting

Bookkeeping Adjusting Entries Reversing Entries Accountingcoach

Discuss The Adjustment Process And Illustrate Common Types Of Adjusting Entries Principles Of Accounting Volume 1 Financial Accounting

Comments

Post a Comment